riverside county tax collector mobile home

Treasurer-Tax Collector Tax Sale Inventory. Bureau of Indian Affairs and the Torres-Martinez Desert Cahuilla Indians have agreed in principle to move forward on an MOU that would seek closure.

Department of Environmental Health County of Riverside Foods This Program visits approximately 11000 retail food facilities to ensure safe food handling practices proper sanitation and compliance with the California Health and Safety Code within the county.

. To obtain certified copies of birth or death records for 2020 or earlier please contact the County of Riverside Assessor-County Clerk-Recorder at 951 955-6200 or visit their website. 124 N Riverside Dr New Smyrna Beach FL 32168 Map to location. Riverside County Information Technology Geographic Information Systems RCIT-GIS departments website.

For rent This 3242 square foot single family home has 5 bedrooms and 40 bathrooms. Invoices were sent to the email address on your people record. A tax collector service fee is added to motorist services fees.

It is located at 5615 Via Cerezo Riverside California. An extraordinary public servant Senator Dutton spent over 50 years serving the community he loved. A Riverside County Environmental Health Permit for construction reconstruction or destruction of a well is required throughout the county.

For questions regarding the Stormwater Compliance Program please contact staff at. The central appraisal district is the entity charged by law with this task. If you have not received your invoice please contact the office immediately at 600-3357.

727 Riverside Ln Ottumwa IA 52501-4037 is a single-family home listed for-sale at 0. View more property details sales history and Zestimate data on Zillow. THE COUNTY OF RIVERSIDE PLEASE CLICK HERE Commercial Cannibis Info.

24 August 2022 Riverside County Federal Government and Tribe Reach Agreement Regarding Future of Oasis Mobile Home Park OASIS Riverside County Supervisor V. Senator Dutton leaves behind his loving wife of over 40 years Andrea daughter Kara. Manuel Perez announces that the county the US.

Proper construction of new wells and proper reconstruction or destruction of existing wells is critical. The website will be undergoing maintenance on September 18 2022 from 700 AM to 1200 PM PST. This mitigation fee was authorized by the Board of Supervisors to fund the acquisition of land buildings furnishings and apparatus necessary to mitigate fire risks.

Orange County has one of the highest median property taxes in the United States and is ranked 119th of the 3143 counties in order of median property taxes. Locations marked with an asterisk are county tax collector-sponsored service centers. Contained here is the inventory of all Sacramento County warrants excluding those warrants that are considered private such as welfare payments child support and employee payroll that have been issued and mailed but which remain uncashed six months after their issue date.

659 for a complete list of exemptions credits or reductions which apply to this county-wide mitigation fee. Mobile round-up is back for 2022 at the big fresno fair grounds. Please visit the County of Riverside Planning Departments Cannabis webpage.

Home is a 3 bed 10 bath property. Online payments will be unavailable during this time. Brazoria county tax office does not administer the process of setting values for property tax purposes.

The Riverside County Treasurer-Tax Collector is responsible for the billing and collection of property taxes and for the receiving processing investing and most importantly safeguarding of public funds as mandated by the laws of the State of California. Annual permit notice for mobile food vehicles. Health permit fees may be paid by accessing your account on the new citizen portal.

Sacramento County Auditor-Controllers website for uncashed County warrants. Mobile Home RV Construction. PayReviewPrint Property Tax Bill Related Information.

Secured Property Taxes FAQ Supplemental Property Taxes FAQ Delinquent Property Taxes FAQ Mobile Home Property Taxes FAQ Installment Payment Plan FAQ Property Tax Postponement FAQ The Assessors office has made several videos to help the public better understand certain aspects of California property taxes. Visit the tax collector website for. SAN BERNARDINO CA July 23 2022 Senator Bob Dutton ret Rancho Cucamongas longtime statesman community member and friend has passed away at the age of 71.

The median property tax in Orange County California is 3404 per year for a home worth the median value of 607900. Storm Water Compliance Announcement Introducing PLUS Online The public portal to the Riverside County. Our team designs and builds web and mobile applications for different departments and purposes on platforms such as ArcGIS Online ArcGIS Enterprise and Geocortex.

Orange County collects on average 056 of a propertys assessed fair market value as property tax. Please address all inquiries regarding values and submission of protests forms or exemption applications to the following. The combined office is led by Matthew Jennings a countywide publicly elected official serving the fourth largest county in.

Protecting the quality of ground water in Riverside County is a priority. The 2022-23 Property Tax bills are scheduled to be mailed the last week of September 2022. Refer to Riverside County Ordinance No.

Riverhead Ny Mobile Manufactured Homes For Sale Realtor Com

Lobelville Tn Real Estate Homes For Sale Re Max

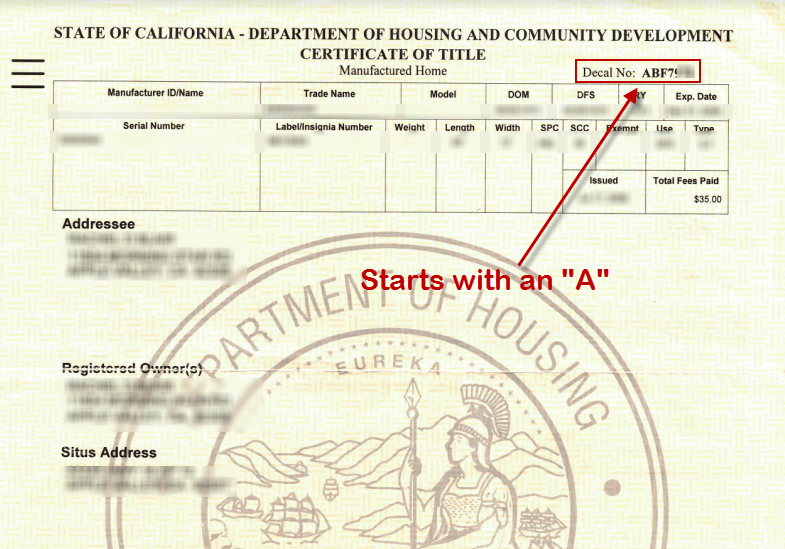

How To Transfer A Mobile Home Title In California Mobile Home Investing

Aumsville Or Real Estate Homes For Sale Re Max

Meet Your Treasurer Tax Collector

Zora Lavinski S Moving Rooming House By Winonacookie Steampunk Art Steampunk Original Collage

Mondovi Wi Real Estate Homes For Sale Re Max

Zora Lavinski S Moving Rooming House By Winonacookie Steampunk Art Steampunk Original Collage

Zora Lavinski S Moving Rooming House By Winonacookie Steampunk Art Steampunk Original Collage

29137 Salley Sc Real Estate Homes For Sale Re Max

How To Transfer A Mobile Home Title In California Mobile Home Investing